How to Calculate Dividend Per Share

Ad Nyse Nasdaq Amex Otcbb Dividend Tracker. Wide Range Of Investment Choices Including Options Futures and Forex.

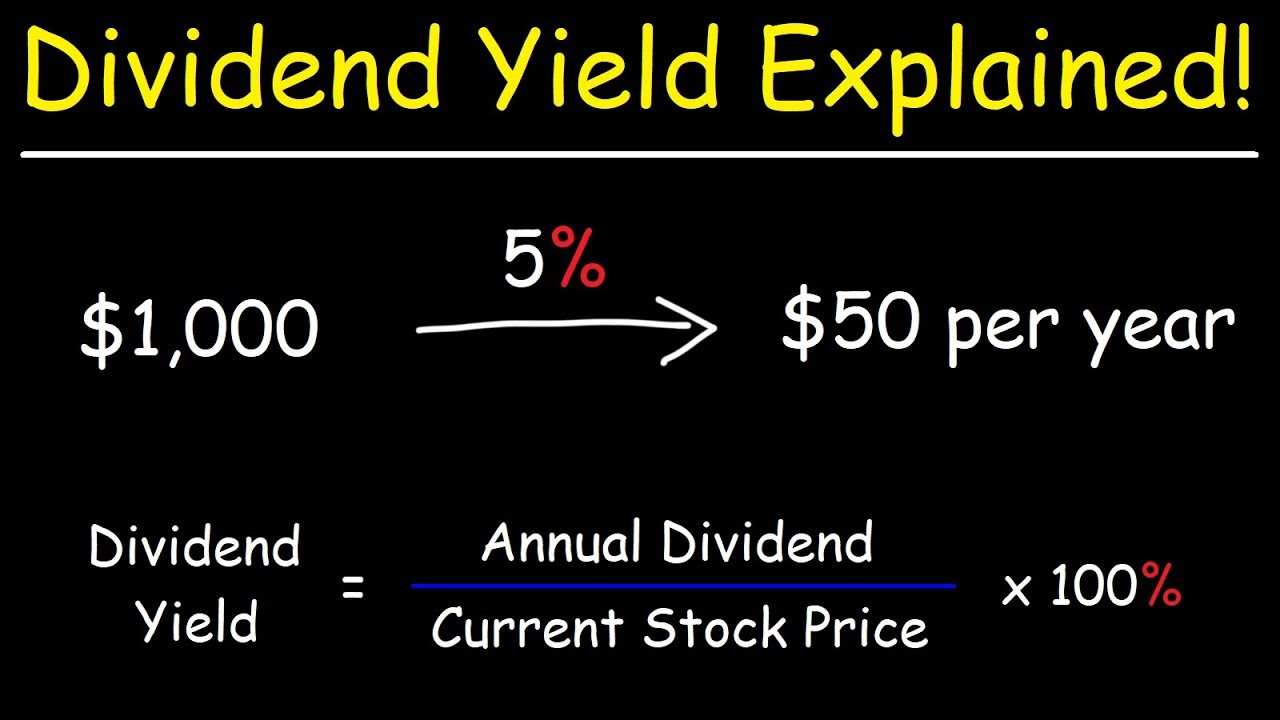

The Dividend Yield Basic Overview Youtube

Lets get started today.

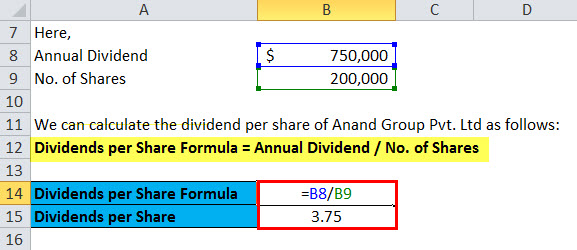

. How is dividend growth calculated. DPS Dividends. The dividend per share will be calculated as follows.

To calculate the dividend per share you need to know the total dividends paid and the outstanding shares. A company must first calculate its per-share earnings for the period quarter or year before deciding on a dividend. The industry and the business cycle of a company can impact the yield of a company.

175 x outstanding sharesoutstanding shares. Dividend per share Total cash dividend Outstanding common stock. Dividend per share 1000000 100000 2000000.

The outstanding shares are the total of all shares currently held by shareholders. It allows the investor to determine the amount of cash they will get on the basis of the shares they hold. Calculating the Dividend Payout Ratio.

Dividend per Share Rs Sum of Dividend Paid over the Year Special One time Dividend Paid in the Period Number of Outstanding Shares. Total dividends are Rs 175 per share. The dividend per share is one of the important metrics.

The formula is. The dividend payout ratio can be calculated as the yearly dividend per share divided by the earnings per share EPS or equivalently or divided by net. Wondering how to calculate the dividend per share of a stock.

Which is the dividend yield of the stock would be 10100100 10. We want you to use the calculator to pull out the product as referred earlier and the product will be Rs045. Dividend per share Earnings per share x dividend payout ratio.

Dividend per share DPS is the total dividends paid. Computing dividends per share. In this video we will explain what is dividend per share and how you can calculate the dividen.

To calculate dividend growth we start by calculating dividend growth from one year to the next. The calculation with the help of the dividend per share formula is simple. In a rapidly growing stage a company might be best off not paying any.

The basic formula to calculate dividend per share is total amount paid divided by total shares outstanding. The formula to calculate the dividend per share is. Even if you put it in the formula the total number of outstanding shares cancel out.

Lets look at Home Depot again which has paid the following dividend amount per share each year since 2016. Ad Diversify your portfolios by providing Access to alternative Investments. This video covers the basics of dividend dividend per share with example in HindiHere we explain what is dividend how to get money from dividends divide.

Let us take a look at how to calculate this in practice with our example of ExxonMobil. How to Calculate Dividend per Share. Diversify your Portfolio by providing Access to alternative Investments.

Earnings per share Net income preferred dividendscommon shares outstanding Net income minus preferred dividends will often appear on company income statements as net. Dividend per share DPS is the sum of declared dividends issued by a company for every ordinary share outstanding. Trade stocks bonds options ETFs and mutual funds all in one easy-to-manage account.

The dividend per share formula is as follows. Here is the workout. Here the calculation is pretty simple.

Ex-Dividend Dates Dividend Calendar All-Star Rankings Special Divs More. Ad Were all about helping you get more from your money. To calculate dividend per share add together the sum of all periodic and special dividends in a year and then divide by the weighted average number of common shares that were outstanding during the same period.

Dividend Per Share - DPS.

Dividends Per Share Formula Calculator Excel Template

Dividends Per Share Meaning Formula Calculate Dps

Dividends Per Share Dps Formula And Calculator Excel Template

Comments

Post a Comment